PARAMITA'S Bespoke LDI/ALM Trading

Most Defined-Benefit (DB) public/private pension plans have been going through transition into Defined- Contribution (DC) or US style 401K plan. To mitigate a DB plan's balance sheet volatility & to achieve a diligent ALM, Paramita Capital is excellent at providing the bespoke Liability Driven Investment (LDI) advisory and/or outsourced trading services to the plan sponsors. The methodology & framework can also be mapped to non-pension related LDI, such as Insurance Co.'s dynamic hedging need for different LOBs or Banks' Treasury ALM functions.

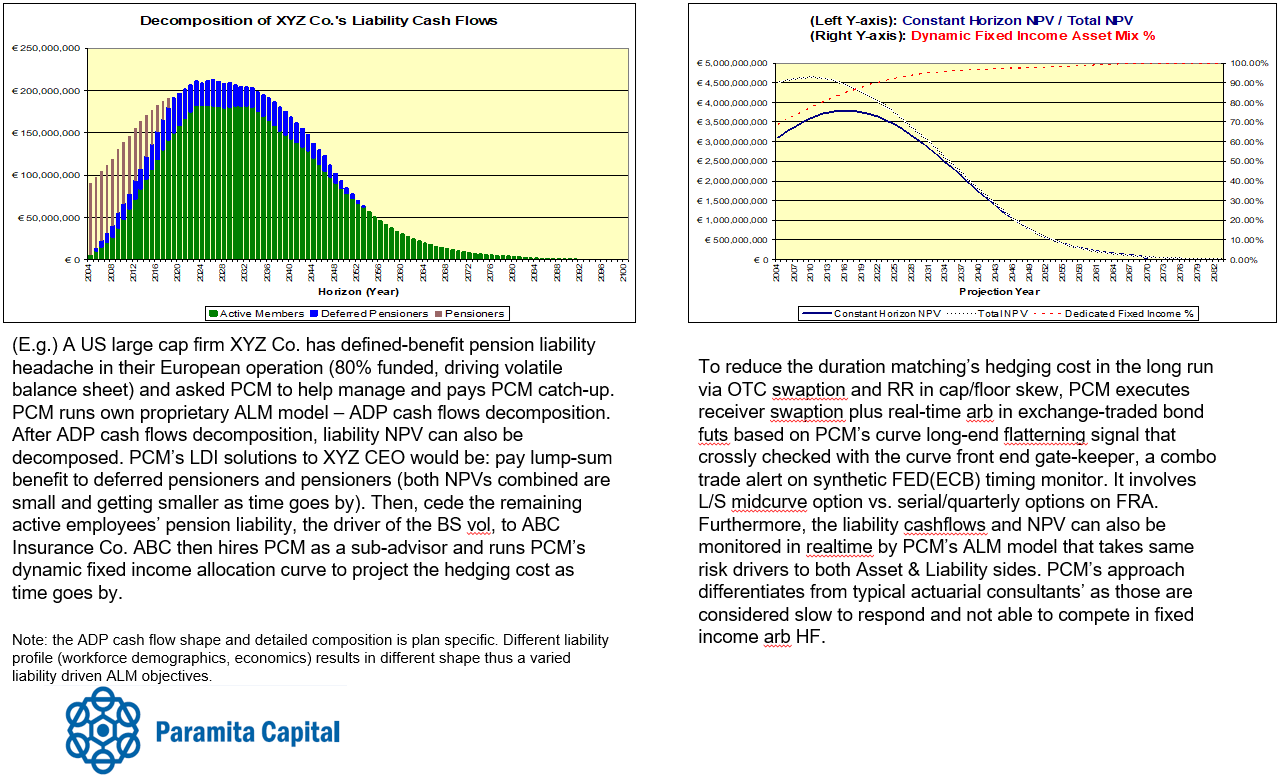

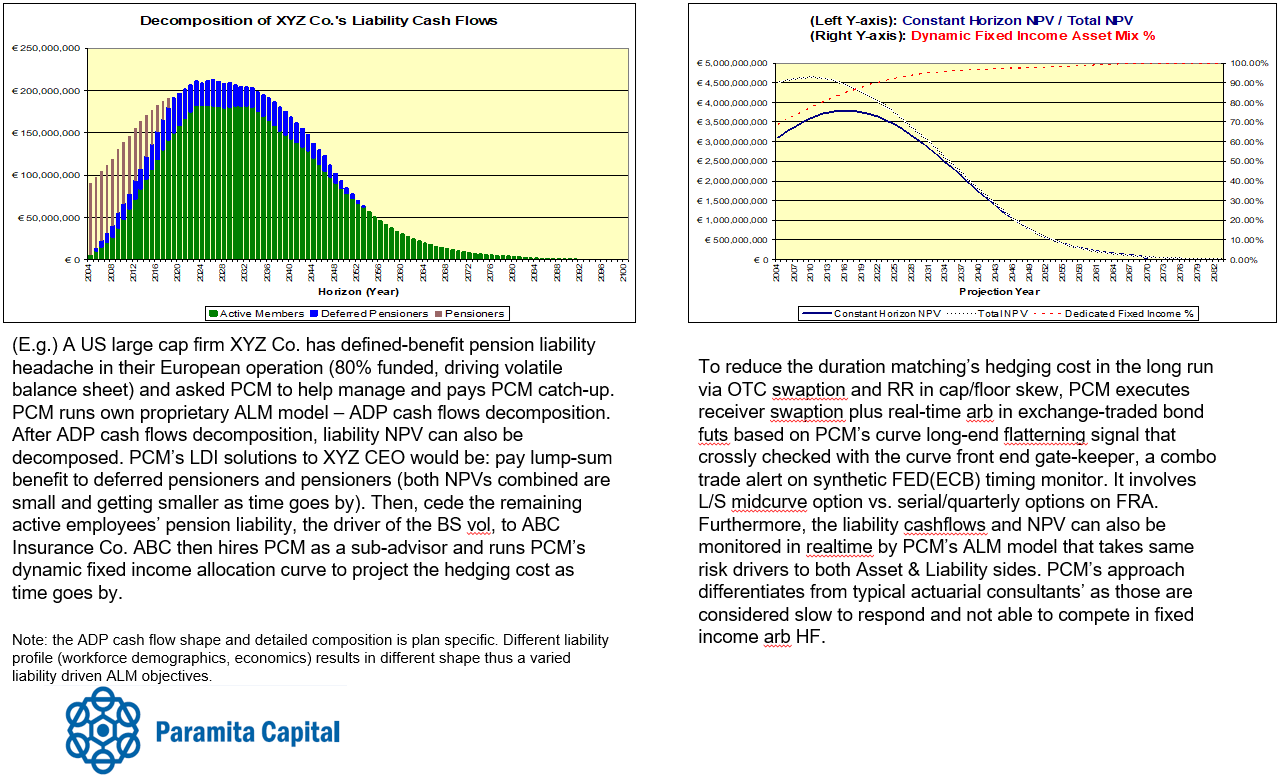

The case study below shows how Paramita Capital helped a US based corporate pension client to implement a new LDI framework by adopting HF-like trading solutions diligently.